dragonfly doji candlestick: Dragonfly Doji: Understanding This Pattern

Contents:

When a pin bar forms the point where the candle opened and where it closed are always different, you see this as the body of the pin. When dragonfly or gravestone doji candlestick forms there is almost no difference or a really tiny difference between the open and close price meaning there is no body found on the candlestick. Dojis are popular reversal candlestick patterns in the financial market.

Doji patterns indicate a transition in prices or that the market is undecided about the direction prices will take. As a category, they are best described as a transitional pattern rather than a reversal or continuation pattern. Specific types of Doji patterns – like the Dragonfly or the Gravestone – can signal a possible reversal in prices but are best used in conjunction with other indicators. The Dragonfly Doji chart pattern is a “T”-shaped candlestick that’s created when the open, high, and closing prices are very similar. Although it is rare, the Dragonfly can also occur when these prices are all the same. The most important part of the Dragonfly Doji is the long lower shadow.

Spinning topsappear similarly to doji, where the open and close are relatively close to one another, but with larger bodies. In a doji, a candle’s real body will make up to 5% of the size of the entire candle’s range; any more than that, it becomes a spinning top. We use the information you provide to contact you about your membership with us and to provide you with relevant content. Learn everything you need to know about trading the markets from beginner level to the most advanced, helping you to create critical skills and techniques to you can apply in your trading right away. This means traders need to find another location to stop losses, or they may need to stop trading.

So, to learn more about a doji candle and how to use this one-candle pattern, let’s see the full review below. TrendSpider is a suite of research, analysis, and trading tools (collectively, the “platform) that are designed to assist traders and investors in making their own decisions. Our platform, its features, capabilities, and market data feeds are provided ‘as-is’ and without warranty.

Trading Strategies Learn the most used Forex trading strategies to analyze the market to determine the best entry and exit points. Trading analysts Meet the market analyst team that will be providing you with the best trading knowledge. Trading academy Learn more about the leading Academy to Career Funded Trader Program. At gravestone, what happened was a price decrease from before, which tended to rise. Always do your own careful due diligence and research before making any trading decisions. It is a transitional pattern as opposed to a reversal or continuation pattern.

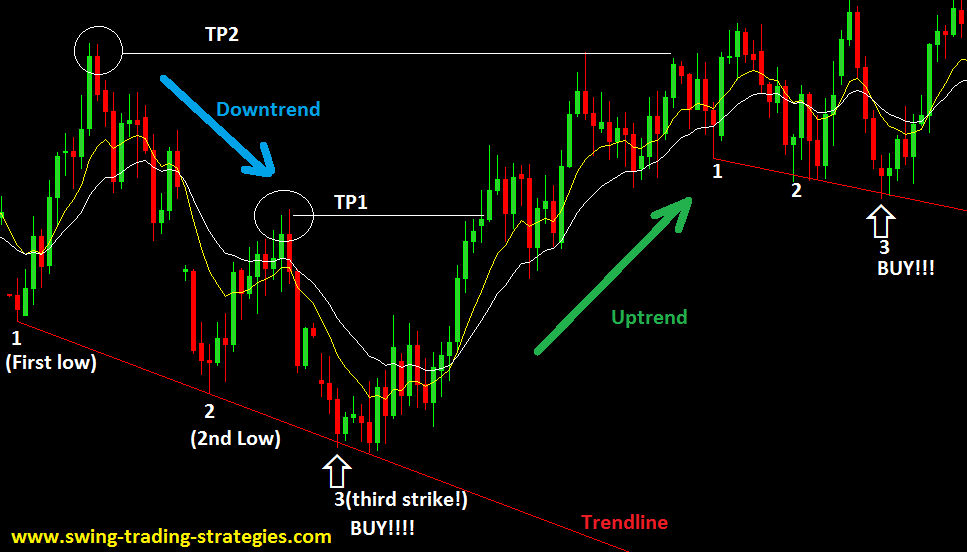

When the trading session begins, the sellers aggressively push the price down. Graphically this translates to the long wick under the body of the candlestick. As mentioned above, the hammer and the dragonfly doji pattern are extremely similar.

Dragonfly Doji Candlestick Pattern

Since the dragonfly doji candlestick and open is the same, it also indicates that the buyers were able to absorb the selling and push the price back up again. Dragonfly DojiQuite the opposite to gravestone doji, since the opening and closing are close to the high of the day. Hence this might suggest that a downtrend might be coming to an end. Now there are various types of Doji candle patterns, and the first is, of course, the standard one. It means that the open and close have happened at the same level. A Dragonfly Doji is a sign of strength because it shows you rejection of lower prices, a variation of this candlestick pattern is the hammer.

- Our platform, its features, capabilities, and market data feeds are provided ‘as-is’ and without warranty.

- Candlestick is a type of charting that contains the open, close, high, and low prices of an asset for a specific time period.

- In Japanese, doji means “blunder” or “mistake”, referring to the rarity of having the open and close price be exactly the same.

- In the middle of the session, the buyers regain control over the buyers and manage to bring the price up to the level of the opening quotation.

However, when the opening and closing prices match, it speaks of indecision. Doji is a category of technical indicator patterns that can be either bullish or bearish. The Dragonfly Doji is a bullish pattern that can indicate a reversal of a price downtrend and the start of an uptrend. Note that most traders will verify the possibility of an uptrend by waiting for confirmation the following day.

Advantages of implementing Dragonfly Doji in your tech analysis

The tail appears when the price opens at a high and then drops to a low due to a lot of selling. Investors can see this moment as a sign to get out of the trading trend. Apart from the regular pattern of Doji, we also have the gravestone pattern. Long legged DojiAs it’s pretty evident that the price movement is equal between the bulls and the bears. However, since there is active participation from both the bulls and bears, suggesting volatility in the price soon. A Gravestone Doji is a sign of weakness because it shows you rejection of higher prices.

This tells you that, “hey, the market is willing to buy at these higher prices, and there’s a good chance that this market could breakout higher and you can look to trade the break out of the highs.” You can see the market rejected higher prices and finally closing near the lows. If you notice, the market is above the 50-period moving average and it tends to bounce off it repeatedly.

They are formed when the price opens and closes at the same level in a sign of consolidation. The dragonfly is an important reversal pattern that you should consider using in your day trading. When it forms at the bottom of a downtrend, the dragonfly doji is considered a reliable indication of a trend reversal. This is because the price hit a support level during the trading day, hinting that sellers no longer outnumber buyers in the market.

What is Doji candle pattern in crypto and how to trade with it? – CoinGape

What is Doji candle pattern in crypto and how to trade with it?.

Posted: Wed, 15 Feb 2023 08:00:00 GMT [source]

The stop loss can be set on the low of the Japanese candlestick representing this graphic pattern. Moreover, when we observe this recurring pattern, we feel the buying pressure, and therefore we can position ourselves quite serenely on the purchase. The probability of leading to a profitable trade is very high. When Dragonfly Doji appears on a price chart, this candle is a signal that should alert to a probable change in the trend, namely a bearish or bullish reversal. This Japanese candlestick means that there is a downward trend, and a bullish corrective movement followed this. However, the buyers took over the market at the end of the day.

To be valid, confirmation candlesticks must be accompanied by strong volumes. Strong volumes accompanying the Doji Dragon also considerably strengthen the signal. In an uptrend, the confirmation candlestick should be a bearish candle closing below the Doji Dragon low. When the confirmation candlestick is bullish, it suggests more of a continuation or a break in the trend. This singularity indicates that the opening and closing prices are equal or almost at the high of the session.

How to trade dragonfly doji?

Commodity.com is not liable for any damages arising out of the use of its contents. When evaluating online brokers, always consult the broker’s website. Commodity.com makes no warranty that its content will be accurate, https://g-markets.net/ly, useful, or reliable. Successful traders will typically wait until the following day to verify the possibility of an uptrend after a Dragonfly.

Even with the confirmation candlestick, it is not guaranteed that the price will continue the trend. Typically, a dragonfly doji with a higher volume is more reliable than one with a lower volume. They usually create orders right after the confirmation candlestick appears. A trader can long a stop loss below the low of a bullish dragonfly or short a stop loss above the high of a bearish dragonfly.

All ranks are out of 103 candlestick patterns with the top performer ranking 1. “Best” means the highest rated of the four combinations of bull/bear market, up/down breakouts. A Dragonfly Doji is a type of single Japanese candlestick pattern formed when the high, open, and close prices are the same. The dragonfly doji is a solid trend reversal pattern that certainly should be part of your trading toolbox. You should consider whether you can afford to take the high risk of losing your money. The dragonfly doji is used to identify possible reversals and occurs when the open and closing print of a stock’s day range is nearly identical.